GARMIN REPORTS SOLID FISCAL 2016 REVENUE AND OPERATING INCOME GROWTH

Feb 26, 2017

Garmin Ltd. (Nasdaq: GRMN – News) has announced results for the fiscal‐year ended December 31, 2016.

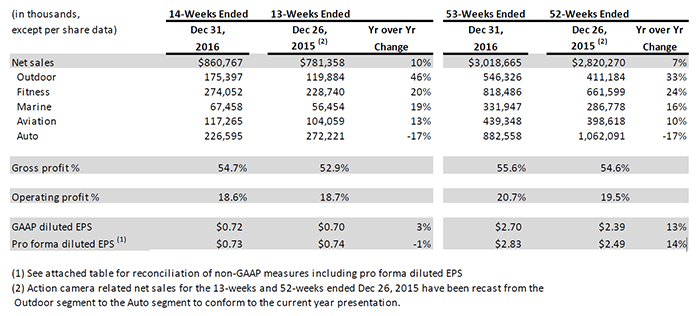

Highlights for the fourth quarter 2016 include:

-Total revenue of $861 million, growing 10% over the prior year, with outdoor, fitness, marine and

aviation collectively growing 25% over the prior year quarter and contributing 74% of total revenue

-Gross margin improved to 54.7% compared to 52.9% in the prior year quarter

-Operating margin of 18.6% compared to 18.7% in the prior year quarter

– Operating income growth of 10%

-GAAP EPS was $0.72 and pro forma EPS(1) of $0.73 for fourth quarter 2016

-Introduced the fēnix® 5 with three watch designs that are expected to appeal to a broader range of

wrist sizes and style preferences

Highlights for the fiscal year 2016 include:

-Total revenue of $3,019 million growing 7% over the prior year, with outdoor, fitness, marine and

aviation collectively growing 21% over the prior year and contributing 71% of total revenue

– Gross and operating margins of 55.6% and 20.7%, respectively, both improving from 2015 levels

-GAAP EPS was $2.70, a 13% improvement over the prior year, and pro forma EPS(1) was $2.83, a 14%

improvement over the prior year

-Shipped approximately 16.8 million units, up 4% from the prior year and over 173 million since

inception

-Connect IQ app store establishes itself with over 2,500 apps and over 24 million downloads since Inception

Executive Overview from Cliff Pemble, president and Chief Executive Officer:

“2016 was a remarkable year of growth driven by strong sales in our outdoor, fitness, marine, and aviation segments,” said Cliff Pemble, president and Chief Executive Officer of Garmin Ltd. “Entering 2017, we see additional growth opportunities ahead and we are well positioned to seize these opportunities with a strong lineup of great products.”

Outdoor:

The outdoor segment grew 46% in the quarter with significant contributions from wearable devices combined with growth in all other product categories and the contribution of DeLorme products. Gross margin remained strong at 61% while operating margin was relatively flat at 33%, resulting in 42% operating income growth. We recently announced our fēnix® 5 series with three different designs all featuring Garmin Elevate™ wrist heart rate technology and our QuickFit™ band replacement system: the fēnix 5S is perfect for smaller wrists without sacrificing multisport functionality, the fēnix 5X includes preloaded wrist-based mapping, and the compact fēnix 5 is feature-packed with an all-new industrial design. We expect outdoor to continue to be a growth segment in 2017 as we leverage opportunities in wearables and other product categories in the segment.

Fitness:

The fitness segment posted strong revenue growth of 20% in the quarter driven by wearables with Garmin Elevate™ wrist heart rate technology. Gross margin increased year-over-year to 52% with operating margin of 17%, resulting in a 15% growth in operating income. The recently launched vívofitjr. was well received by retailers and customers during the holiday quarter and we see additional growth potential for wearables designed specifically for children. We believe fitness will be our largest revenue contributor in 2017, and enter the year confident in our product lineup.

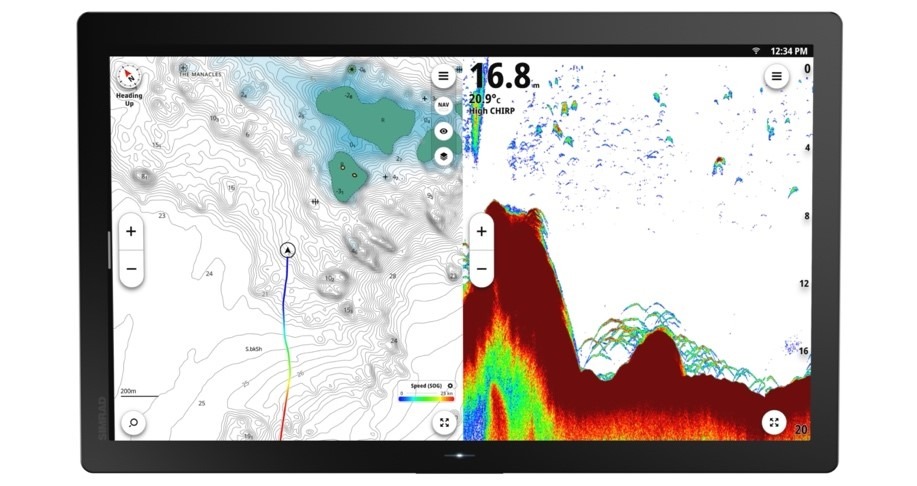

Marine:

The marine segment posted strong fourth quarter revenue growth of 19% driven by our solid lineup of chart plotters and fish finders. Gross margin decreased year-over-year to 52% due to product mix, while operating margin improved to 4%. In the quarter, we introduced new touchscreen and keyed chartplotter combo offerings in our popular GPSMAP® product line, many with built-in sonar, and new radar and entertainment offerings. We expect marine to continue to be a growth segment in 2017 as we focus on market share gains and new product innovations.

Aviation:

The aviation segment posted solid revenue growth of 13% in the quarter with growth contributions from both OEM and aftermarket. Gross and operating margins were 77% and 28%, respectively. During the quarter, we received FAA installation approval for our helicopter ADS-B offerings, supported Cirrus in the certification and initial deliveries of the SF 50 light jet, and Textron Airland announced our selection as the avionics provider for the Scorpion light attack aircraft. We continue to invest in upcoming certifications with our numerous OEM partners, as well as ongoing opportunities for long-term market share gains.

Auto:

The auto segment recorded revenue decline of 17% in the quarter, primarily due to the ongoing PND market contraction. Gross margin remained constant at 42%, while operating margin declined year-over-year to 9%. At the recent CES show we announced our next generation Drive series PNDs, which offer expanded safety and driver awareness features and WIFI capability that enhances the process of updating maps and other content stored on the device. During the quarter, we were chosen as a Tier 1 infotainment hardware supplier for BMW affirming recent investments in our OEM program.

Additional Financial Information:

Total operating expenses in the quarter were $311 million, a 16% increase from the prior year. Advertising increased 19%, driven by year-over-year increases in the fitness and outdoor segments to support wearables. Research and development and selling, general and administrative expenses increased 22% and 9%, respectively, due primarily to recent acquisitions and an additional week in our fourth quarter 2016.

The effective tax rate in the fourth quarter of 2016 was 19.0%, an increase from 13.2% in the prior year quarter. The year-over-year increase in the fourth quarter 2016 tax rate is primarily due to the recording of a full year of the U.S. research and development tax credit in the fourth quarter of 2015 versus being spread over four quarters in 2016.

In the fourth quarter of 2016, we generated $165 million of free cash flow (see attached table for reconciliation of this non-GAAP measure). We continued to return cash to shareholders through dividends and share repurchases. As a result of the additional week in the fourth quarter 2016, two quarterly dividends were recorded totaling approximately $192 million and we repurchased approximately $28 million of Company stock. We have approximately $75 million remaining in the share repurchase program which was extended through December 31, 2017, and expect to repurchase Company stock as business and market conditions warrant. We ended the quarter with cash and marketable securities of approximately $2.3 billion.

2017 Guidance:

| 2017 Guidance | |

| Revenue | ~$3.02B |

| Gross Margin | ~56% |

| Operating Margin | ~20% |

| Tax Rate (Pro Forma) | ~22% |

| EPS (Pro Forma) | ~$2.65 |

We expect 2017 revenue of approximately $3.02 billion as growth in outdoor, fitness, marine and aviation is offset by ongoing declines in the PND market. We expect gross margins to be approximately 56%, relatively flat to the prior year. Operating margin is expected to be approximately 20%. With a pro forma expected tax rate of approximately 22%, we currently forecast 2017 pro forma EPS of approximately $2.65. The expected year-over-year increase in the 2017 pro forma tax rate is primarily due to the Company’s election to adjust certain Switzerland tax positions to address potential tax risk from evolving global tax initiatives.

Dividend Recommendation:

The board of directors intends to recommend to the shareholders for approval at the annual meeting to be held on June 9, 2017, a cash dividend in the amount of $2.04 per share (subject to possible adjustment based on the total amount of the dividend in Swiss Francs as approved at the annual meeting), payable in four equal installments on dates to be determined by the Board. The Board currently anticipates the scheduling of the dividend in four installments as follows:

| Dividend Date | Record Date | $s per share |

| June 30, 2017 | June 19, 2017 | $0.51 |

| September 29, 2017 | September 15, 2017 | $0.51 |

| December 29, 2017 | December 15, 2017 | $0.51 |

| March 30, 2018 | March 15, 2018 | $0.51 |

In addition, the board of directors has established March 31, 2017 as the payment date and March 15, 2017 as the record date for the final dividend installment of $0.51 per share, per the prior approval at the 2016 annual shareholders’ meeting. The first, second and third payments of $0.51 per share were made on June 30, 2016, September 30, 2016, and December 30, 2016, respectively.

Webcast Information/Forward-Looking Statements:

An archive of the live webcast will be available until April 27, 2017 on the Garmin website at www.garmin.com. To access the replay, click on the Investor Relations link and click over to the Events Calendar page.

This release includes projections and other forward-looking statements regarding Garmin Ltd. and its business that are commonly identified by words such as “would,” “may,” “expects,” “estimates,” “plans,” “intends,” “projects,” and other words or phrases with similar meanings. Any statements regarding the Company’s GAAP and pro forma estimated earnings, EPS, tax rate and revenue for fiscal 2017, the Company’s expected segment revenue growth rates, margins, currency movements, expenses, pricing, new products to be introduced in 2017 and the Company’s plans and objectives are forward-looking statements. The forward-looking events and circumstances discussed in this release may not occur and actual results could differ materially as a result of risk factors and uncertainties affecting Garmin, including, but not limited to, the risk factors that are described in the Annual Report on Form 10-K for the year ended December 31, 2016 filed by Garmin with the Securities and Exchange Commission (Commission file number 0-31983). A copy of Garmin’s 2016 Form 10-K can be downloaded from http://www.garmin.com/aboutGarmin/invRelations/finReports.html .

Garmin, the Garmin logo, the Garmin delta, DeLorme, fēnix, GPSMAP and vívofit, are trademarks of Garmin Ltd. or its subsidiaries and are registered in one or more countries, including the U.S.; Garmin Elevate and QuickFit are trademarks of Garmin Ltd. or its subsidiaries. All other brands, product names, company names, trademarks and service marks are the properties of their respective owners. All rights reserved