Supply Chain Dominoes

Mar 23, 2021

Will “just in time” be just in time to deliver a great summer for the boat business in 2021? Or, will the supply chain dominoes fall against us?

Indications in the main media are that at least North America, is having a faster economic recovery than previously predicted and we already knew that new boats were a hot spot last year with significant unfilled demand coming into summer 2021.

In Boating Industry Canada News Week Digest, we have reported from several boat builders and marine businesses that things were back-ordered already with some boat builders predicting that they would not catch up until 2022.

Then last month, we had the 2021 Texas power crisis resulting from three severe winter storms

that swept across the United States on February 10–11, again from 13–17, and finally from February 15–20. The south-western state’s energy grid was overwhelmed by a surge in demand for heat as temperatures plummeted to 30-year lows, hitting 0F (-18C) when the storms moved in. Austin, the state’s capital, lost 325 million gallons (1.2 billion litres) of water when pipes burst.

These storms caused a massive electricity generation failure in Texas leading to shortages of water, food, and power. More than 4.5 million homes and businesses were left without power, some for several days.

Texas is important to the boat business because the state makes some components that are difficult to replace…and we have a short season to capitalize on the roaring consumer demand for new boats.

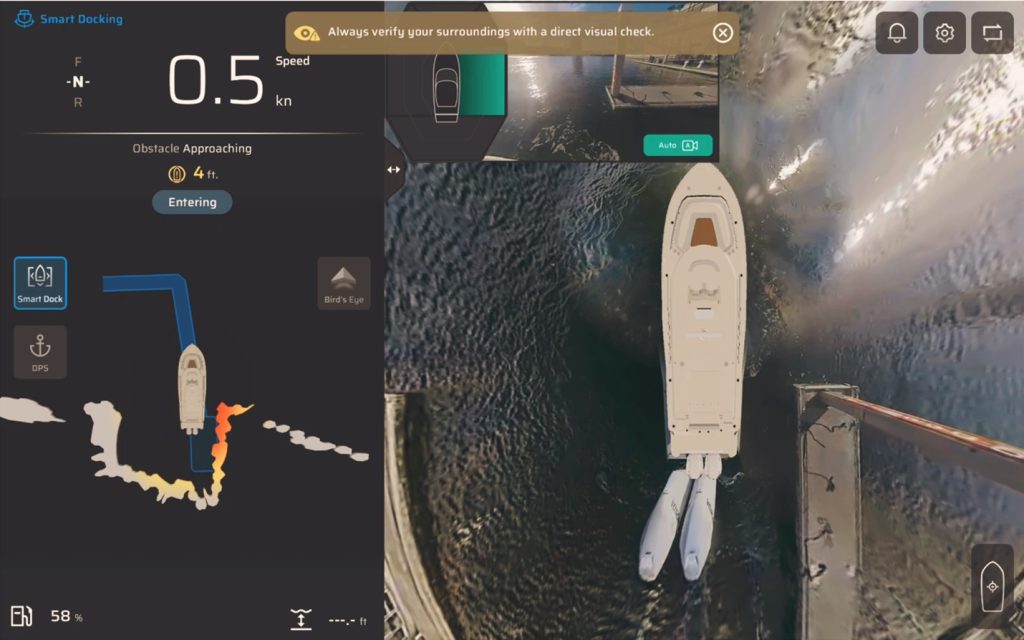

Texas produces a lot of chips – semiconductors that are needed for many of the engine management systems, navigation equipment and even on-board entertainment systems. Those chips may also be needed for similar systems in new cars and trucks, consumer electronics and other high-volume applications. Demand from consumer electronics and automotive will far outweigh the volumes in boating.

The chip issue was well telegraphed. Chip-makers had warned the car-makers when they cut their orders at the start of COVID-19 (expecting dramatically lower vehicle sales in the pandemic), that other industries would want those chips. The COVID-19 “work-from-home” situation drove big chip demand for computers and consumer electronics. Chip buyers were already facing a squeeze.

When the February winter storm hit, it closed computer-chip facilities in Texas, amid a global chip crisis. Texas is the centre of semiconductor manufacturing in the US, with more facilities than any other state. Typically, chip factories have to run 24 hours a day to be economically viable. One media source reported that in the wake of the storm, Samsung, NXP and Infineon had halted production at their Texas facilities. Three weeks later, we still don’t know the full impact from the Texas storms, but the vehicle industry has warned the disruption could amount to billions in lost sales.

The extreme cold also damaged some vital chemical companies in the Gulf area. Apparently, just a handful of major chemical companies produce almost all of the chemicals used to make foam for car seats and we assume, in boat seats. The foam is made with polyurethane, which is manufactured using an organic compound called propylene oxide. This industrial liquid is produced with by-products of the oil refining process.

The upholstery foam issue starts with the fact that the Texas refineries provide the petroleum by-products needed and we understand that high-pressure steam is used in the foam manufacturing process. The storms that froze much of the Texas water system, knocked out the refineries and the water systems. Delivery delays for seat foam could have a devastating effect on boat builders. How can you sell a boat without seats?

President Joe Biden declared a major disaster in Texas, clearing the way for federal funds to be spent on relief efforts in the state and power has returned, but the damage to plants and processes, as well as the delays the storms surely caused in manufacturing and product deliveries could threaten the bright 2021 outlook for boating.

Andy Adams – Editor