Economic Analysis: Proposed Luxury Tax on new boats will be job killer & have major negative impact on boating sector

Nov 30, 2021

The tax will punish dealers, manufacturers, and middle-class workers.

The federal government’s proposed luxury tax on new boats will likely lead to significant job losses and could result in far less revenue than predicted, according to a third-party analysis by renowned economist Dr. Jack Mintz.

The federal government announced in the Budget last spring that it plans to introduce a tax on select items, including new boats above $250,000, beginning January 1, 2022. While the government’s goal of improving social equity is commendable, this tax will only hurt the people it intends to help. “Unfortunately, the government has failed to recognize that a luxury tax won’t target the rich. Instead, it will punish the dealers, manufacturers and middle-class workers who will become collateral damage,” said NMMA Canada president Sara Anghel.

According to the paper by Dr. Mintz – An Economic Evaluation of the Proposed Luxury Boat Tax – written in collaboration with Fred O’Riordan (National Leader, Tax Policy – EY Canada), the proposed tax would lead to a minimum $90 million decrease in revenues for boat dealers and potential job losses of at least 900 full-time equivalent employees.

“Dr. Mintz’s analysis confirms what we know to be true: the proposed luxury tax will be economically destructive to Canadian businesses and is a self-defeating policy that will hurt middle-class workers at dealerships and manufacturing facilities – not to mention those who are employed at marinas and service shops in many boating communities,” said Anghel. “NMMA Canada urges the federal government to correct course on this misguided tax announced in the last budget. We cannot afford to jeopardize our fragile economic recovery by decimating our domestic industry and putting thousands of good, middle-class jobs at risk at a time when we need them most.”

“These findings demonstrate that a luxury tax on boats would hurt, not help, Canadians,” said Dr. Mintz. “Luxury taxes on boats in many other countries have been repealed due to their ineffectiveness in generating revenue, their high administrative costs, and their negative impacts on boat sales. This research confirms the findings of previous literature and underscores the lessons learned from international case studies of similar luxury taxes.”

Dealer Quotes:

“A survey of our customers concluded 66% would not consider making a purchase if subjected to an additional tax. It is clear that a luxury tax will be devastating to our business. We will have no choice but to slash operating expenses. Good-paying, year-round jobs in all areas of our business will be lost. It is a painful irony that the proposed luxury tax, designed to punish the rich, will in fact only hurt middle-class workers.”

• Jason Crate, Crate’s Lake Country Boats -Orillia Ontario

“Through the COVID pandemic, the boating industry has been able to grow because new families became interested in recreational boating. That means, Canadians are spending their money here in Canada and keeping Canadians working, especially in the smaller towns and cities along our canals, lakes, and rivers. I’m concerned a luxury tax will lead to many Canadians buying boats in the US, not allowing Canadian Dealers an opportunity to compete, thus starving us and forcing layoffs and some businesses to close

• Kevin Marinelli, Pride Marine Yachts – Orillia, Ontario

“The industry has encountered a series of blows in recent years in the form of floods, an aluminum tariff, COVID and now the prospect of a luxury tax. The aftermath of COVID has left us dealing with a shortage of skilled labor and little to no inventory and we cannot afford to push back anymore potential customers. The government needs to start supporting small businesses and middle-class employees. We are the road to a strong recovery.”

• Marc Savage, Orléans Boat World & Sports – Ottawa Ontario (Ontario & Quebec)

“When the U.S.A. implemented a similar 10% luxury tax on boats, 150 employees of C&C Yachts in the Niagara Region lost their manufacturing jobs and the plant closed.”

• Jan Willem De Jong, Neptunus Yachts – St Catharines, Ontario

“All EagleCraft recreational sales and approximately 22% of KingFisher Boats sales would fall within the tax threshold, and the tax will severely impact our dealers, employees and suppliers. It would impact our ability to continue the strong operations we currently have, and of equal concern is the prospect of the tax being introduced as we are also developing a new manufacturing facility in response to market demand for larger vessels, including those specifically targeted by the proposed tax.”

• Byron Bolton of family-owned Bryton Marine Group (KingFisher Boats in Vernon, BC and EagleCraft in Campbell River, BC)

“Founded in 1983, Quartermaster Marine is a family-owned business that sells and services boats in Atlantic Canada and employ 25 full time staff,” said. “We view the proposed luxury tax as a serious blow to the Marine industry. It will affect our sales and profit, which will cause us to lay off staff. Luxury taxes has been tried in many other countries and has had the opposite effect.”

• Jason Craig, Quartermaster Marine – Charlottetown PEI

Report’s Key Findings:

• Consumers could easily avoid the Canadian luxury tax on boats by purchasing and keeping their boats abroad, especially for those who reside in communities near the Canada-U.S. border.

• If consumers avoid the tax by purchasing and keeping their boats outside of Canada, as expected, then companies and employees in Canada’s recreational boating industry will bear the brunt of the damage—estimated at $90.5 million in lost sales and 896 lost jobs for FTEs.

• The survival of Canada’s small domestic boat manufacturing base—already hollowed-out by years of competition with low-cost jurisdictions and offshoring—would be directly threatened by the luxury tax. The tax would also have a negative ripple effect on the wider recreational boating industry and other related sectors of the economy.

• Enforcement of the tax would impose additional costly compliance burdens on small business owners who are already strained due to COVID-19 restrictions, supply chain disruptions, and low inventory levels.

About NMMA Canada

National Marine Manufacturers Association (NMMA) Canada is the leading association representing the recreational boating industry – a sector which contributes $5.6 billion GDP annually and supports 75,000 jobs across the country. NMMA member companies produce more than 80 percent of the boats, engines, trailers, accessories, and gear used by boaters and anglers throughout the U.S. and Canada. The association is dedicated to industry growth through programs in public policy advocacy, market statistics and research, product quality assurance and promotion of the boating lifestyle.

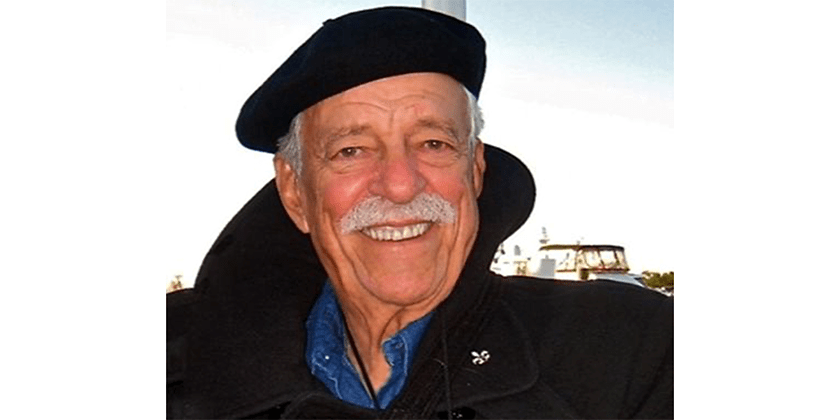

About Dr. Jack Mintz

Jack Mintz is a renowned expert on fiscal and tax policy. A former head of the C. D. Howe Institute, he has influenced the structure of provincial, federal, and international tax systems around the world. Many developing countries have also adopted his corporate tax reforms. A highly regarded teacher and mentor, Dr. Mintz co-founded and directed the School of Public Policy at the University of Calgary, which aims to bridge the gaps between business, government, and academia.