FINANCIAL POST REPORTS – HOW BRP CAUGHT A BIG WAVE, WHILE BOMBARDIER WAS LEFT TREADING WATER

Aug 15, 2017

In a recent story in the Financial Post, writer Alicja Siekierska reported that BRP’s stock is at all-time highs, it has a new dividend and an ambitious growth plan, meanwhile the former parent limps along.

We thought our readers would find this story interesting. It’s a reflection of BRP innovation and the strength of the boating market.

On April 3, 2003, José Boisjoli gathered the 2,000 employees at Bombardier Inc.’s historic recreational product division in Valcourt, Que. to break some big news: The core unit upon which the aerospace and transportation giant had been built was being sold.

With questions swirling about the division’s future — Who would buy it? Would the Bombardier-Beaudoin family still be involved? Would it remain in Valcourt? — Boisjoli, then its president, chose to look at the sell-off as an opportunity.

“Think of it as if we’re a teenager,” he recalled telling the crowd assembled on the plant floor. “We are out of the house and now we need to prove that we can live by ourselves.”

Fourteen years later, that teenager is thriving. While its former parent has struggled with missed delivery deadlines, government loans and compensation controversies, Bombardier Recreational Products Inc. — now branded simply as BRP — has established itself as a global leader in the competitive recreational product market.

With its stock at all-time highs, a new dividend and an ambitious growth plan targeting 50 per cent revenue growth by 2020, BRP is even nipping at Bombardier’s heels when it comes to market capitalization, something that would have been unthinkable when it was spun off.

We are out of the house and now we need to prove that we can live by ourselves

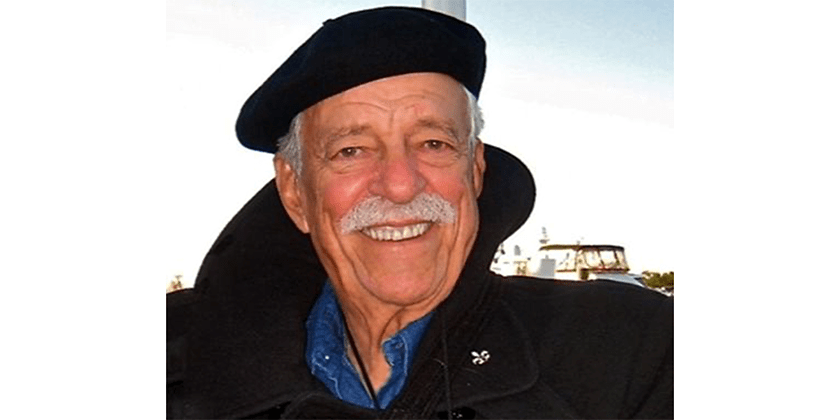

President and Chief Executive Officer of BRP, Jose Boisjoli, with two mechanical parts whose design led to challenges, at his office in the company headquarters in Valcourt, Que. Dario Ayala for National Post

Speaking to the Financial Post in his office in Valcourt, a town practically synonymous with the Bombardier name, Boisjoli, now chief executive of BRP Inc., reflected on the 2003 sale, how the company has grown since then and why it hasn’t suffered the same fate as Bombardier over the last several years.

The spin-off itself, he noted, has been a part of that equation.

“Being separated from Bombardier gave us a chance to prove to the rest of the world that we can be successful on our own,” Boisjoli said.

Bombardier initially decided to sell its legacy recreational product division — originally created as a snowmobile company by Joseph-Armand Bombardier in 1942 — as part of a larger restructuring campaign aimed at convincing investors that the struggling aerospace and transportation company was on the road to recovery.

BRP was bought by a consortium made up of Mitt Romney’s investment firm Bain Capital, the Bombardier-Beaudoin family and pension-fund manager Caisse de dépôt et placement du Québec in Aug. 2003 for $1.23 billion. Then chief executive Paul Tellier, who had to convince the family a sell-off was the right decision, proclaimed Bombardier was back on track after the sale.

Karl Moore, a professor at the Desautels Faculty of Management at McGill University, said the move was a good decision not only for Bombardier, but the recreational product division as well.

“Paul did the right thing in terms of realizing BRP was the orphaned child with two much bigger brothers (in aerospace and transportation),” Moore said.

“At the time, with Bombardier’s capital requirements for the C Series program and what they were doing on the train side, the recreational product division would have been really overlooked and ignored, and probably rightly so, because if you’re CEO of Bombardier, you really need that money for other things.”

The deal has paid off for the Bombardier-Beaudoin family, which — along with Bain – controls approximately 65.2 per cent of the company. The family received more than $3-million this month thanks to the new dividend, and more from selling shares back to BRP through a recent substantial issuer bid. Three family members sit on BRP’s board of directors: chair Laurent Beaudoin, the son-in-law of the Bombardier’s founder; J.R. Andre Bombardier, Beaudoin’s brother-in-law, and Louis Laporte, Beaudoin’s son-in-law.

While the family has been criticized for controlling Bombardier through a dual-class share structure, and sparked outrage when board members were offered significant compensation packages not long after the company received a $376.5 million interest-free loan from the federal government, Boisjoli said the situation at BRP has been different.

“It’s a totally different dynamic than what happened at Bombardier,” Boisjoli said, pointing to the fact that BRP has not received any government support.

“I believe that with shareholders like the family, who knew the business and knew the product, with the Caisse de dépôt et placement du Québec involved from the beginning, and Bain coming in as a total outsider, it gave us a chance to be challenged by people from the outside and (revisit) the way we were doing things,” Boisjoli said.

“We were challenged more than ever before. Sometimes there were arguments between the two big shareholders, but I think at the end of the day, if offered a new look at the way you do things. It resulted in a very good dynamic.”

Both Beaudoin and his son Pierre led the recreational product division before it was sold off.

I do not think they have been hands on in the way they were with Bombardier. At BRP, they are letting other people run the show and they are being patient because they really understand the business. Certainly Pierre and Laurent have a good sense of what it takes

Pierre Beaudoin, left, chairman of Bombardier Inc., and chairman emeritus Laurent Beaudoin are among the major shareholders of BRP Inc. Graham Hughes for National Post

As Moore puts it, regarding the family’s role: “I don’t think they’ve been hands on in the way they were with Bombardier. At BRP, they are letting other people run the show and they are being patient because they really understand the business. Certainly Pierre and Laurent have a good sense of what it takes.”

The market results have been indisputable.

Since going public in May 2013 at an IPO price of $21.20, BRP’s stock has soared by more than 80 per cent. In June, it announced its first quarterly dividend, sending shares to an all-time high of all-time high of $40.53 and prompting many analysts to boost their end-of-year target prices.

Bombardier shares, meanwhile, have plunged nearly 49 per cent during the same time period. According to Bloomberg, as of late July, BRP had a market cap of $4.2 billion while Bombardier sits at $5.4 billion.

Also crucial to BRP’s success has been a focus on product development and innovation, and creating significant efficiencies in the manufacturing process.

Not far from Boisjoli’s office, as the sun glares outside on a warm July day, workers inside the BRP factory tucked just behind the Valcourt town sign are busy building snowmobiles for the coming winter season. Sparks fly from robotic welding machines, while employees zip around aisles on , bringing supplies to various production stations. The assembly line, based on the Toyota Production System model, hums as white Ski-doos are pumped off one-by-one and prepared for packaging.

Since being spun out, BRP has expanded from producing snowmobiles and personal watercraft to an all-season recreational company featuring a six-product line that includes outboard engines, Rotax engines, off-road and on-road vehicles. Its Ski-Doo, Lynx and Sea-Doo lines are the top brands in their markets, with revenues reaching about $1.5 billion last year. Its most successful product is its year round line, featuring the three-wheeled Spyder, side-by-side vehicles and ATVs, which brought in more than $1.6 billion last year.

“The introduction of new models into segments that they previously didn’t serve, particularly in the side-by-side space, and fairly aggressively adding to their lineup in those segments has been a big driver of their success in that they’ve been able to gain market share,” said Cameron Doerksen, an analyst with National Bank Financial.

Tim Conder, an analyst with Wells Fargo Securities, said in a note to clients that investors under appreciate the strategic groundwork management has put in place, through streamlined product innovation and optimizing its dealer network.

The company has also gradually shifted a large portion of production from Quebec to Mexico, where about 3,600 work at three assembly facilities, in addition to facilities in Austria, Finland, North Carolina and Wisconsin. About 8,700 employees work at BRP.

Doerksen said BRP’s ability to successfully launch new and improved products — such as the more affordable Sea Doo Spark — are due in part because of the manufacturing facilities in Mexico.

“That’s definitely been a very significant part of BRP’s success,” Doerksen said. “Their ability to enter these new markets with new products and accelerate growth has a lot to do with being able to offer a lower-cost product.”

Among BRP products are the Can-AM Spyder, the Ski-Doo, Can-AM off-road vehicle and Evinrude motors. Handouts

But its revamped, cost-efficient manufacturing footprint could be at risk if there are major changes in the North American Free Trade Agreement renegotiations. Although U.S. President Donald Trump has stepped back previous threats of tearing up the trade agreement, the company has substantial stake in renegotiations, given it has over $1 billion in trading volume between Mexico and the U.S.

“Let’s just say I don’t wake up at night because of it, but if I wake up at night, I think about it,” Boisjoli said, about the fate of NAFTA.

“We were more concerned when the administration took over at the beginning of the year. Now we have better clarity on the process, which is normal, and we believe we’ll find way to overcome difficulty if there is any.”

Looking forward, BRP has set an ambitious goal of hitting $6-billion in revenues by 2020, up from $4.17 billion in fiscal 2017. Boisjoli said product innovation is just one of the many options currently being discussed when it comes to reaching that profit target.

“Whether it’s a seven-product line that we do from the inside, something that we acquire or something we sign a partnership for, it’s not defined yet,” he said. “But we have a group of about 15 people working on this for the last 12 months. There are many options. I’m travelling the world to help see what will be next.”

Along a window ledge of Boisjoli’s office are reminders of some of the challenges it has faced since 2003, including snowmobile parts that presented design obstacles.

“When I look at what will come in the next three years, it’s a lot more than we’ve done in the last three,” Boisjoli said.

Like many of the products it builds, Boisjoli is content to see BRP forge its own path forward.

“We are very autonomous in the way we do things, with a strong board and strong governance,” he said. “At the end of the day, we don’t deny our history, our past and we don’t deny that (Bombardier) are going through a more difficult time in the last few years. We’re having our own story, our own success.”