SECOND WAVE DATA – BOATING INDUSTRY CANADA BUSINESS IMPACT SURVEY

May 4, 2020

By Andy Adams

Thank you to the 200 readers who have responded to the Second Wave of research that Boating Industry Canada sent out May 1. We have again surveyed the recreational boating stakeholders in Canada on the business impact brought on by the current COVID -19 situation.

The Second Wave results again give a broad perspective with all segments represented from right across Canada. With the concentration of the industry in Ontario, that province again led in overall responses at 68.5% followed by British Columbia at 18.5% and then Quebec at 7%. Remember when considering the Quebec number, that News Week is only in English.

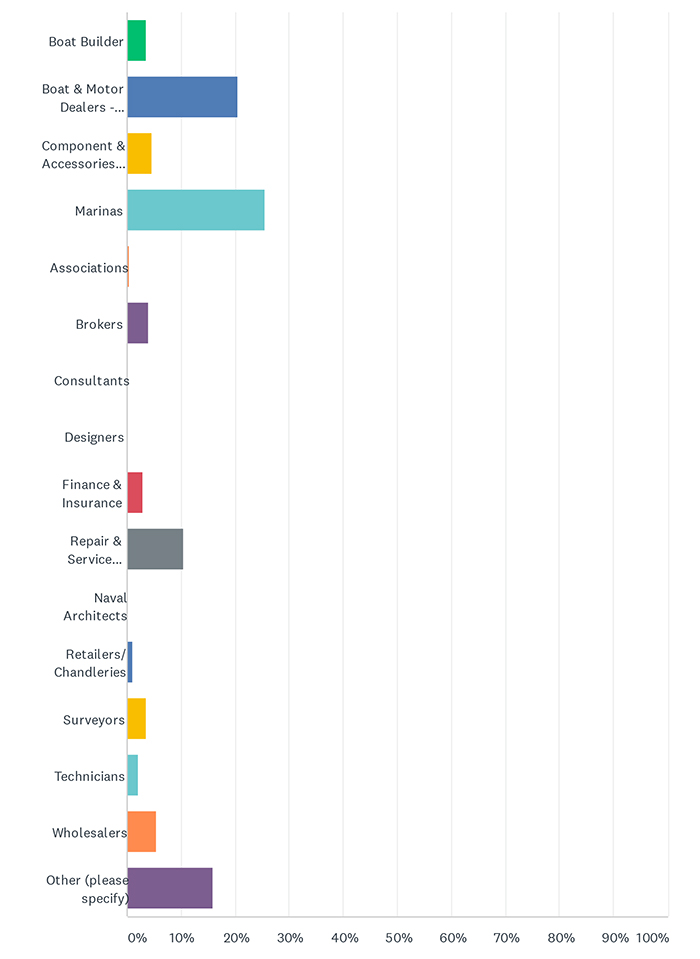

All major firms were represented across the broader segments of Dealers and Retail. Wholesaler distribution , and Marinas and related suppliers. Respondents were asked to classify themselves in a tighter view resulting in 44.22% of the response coming from the marine dealer dealers compared to 47% in the First Wave data from April 20. This time 82.4% of the respondents were in the owner or management Job function compared to 81% on the First Wave.

Table 1: Profile of the responses by segment in detail, May 1 Survey

The Second Wave responses come from a relatively similar profile of respondents so it seems that Wave 1 and Wave 2 can be compared fairly closely.

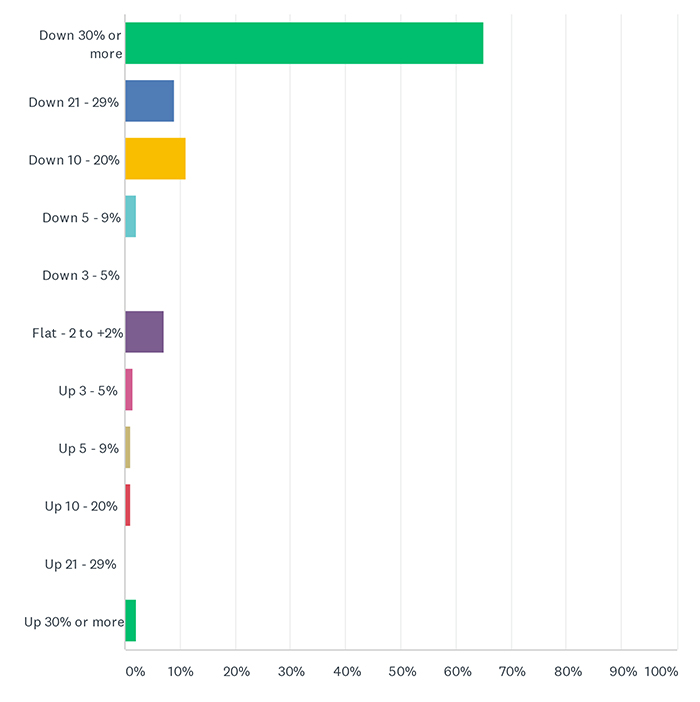

Clearly the impact of the provincially mandated responses continue to impact sales. Second Wave responses have 65% of the industry indicating a loss of 30% of sales compared to 70% in the First Wave. In the past two weeks, there may have been an increase in sales as we hopefully move closer to a season opening.

Table 2: How has the COVID-19 pandemic impacted your sales?

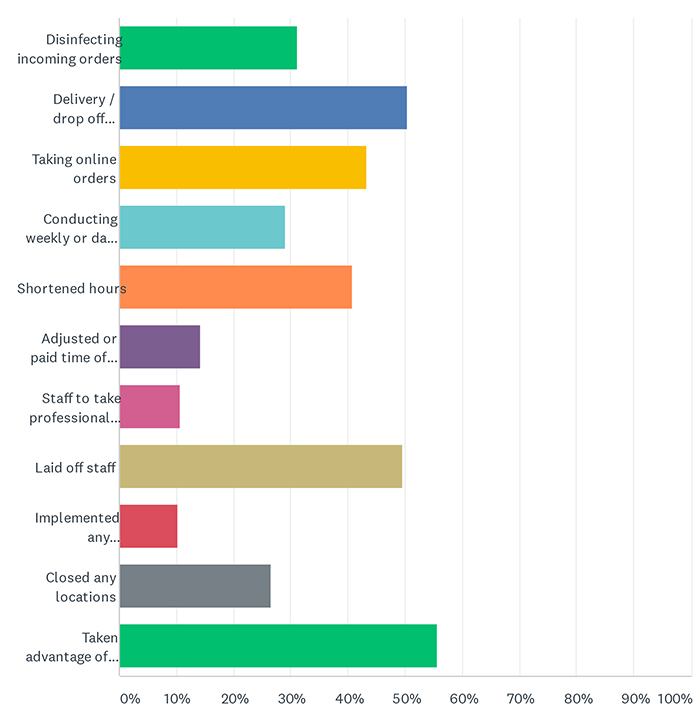

One of key findings and insights is evidenced by what business actions firms have taken in response to COVID -19. Personnel and staff layoffs were at 45% in the First Wave and these have risen to 49.5% in the Second Wave. Tied to that, we now see that 55.6% have tried to take advantage of the Government subsidy, loans of emergency relief programs. We see that 40.8% have shorter hours, 43.3% are taking orders online and 50.5% are have implemented delivery and drop off protocols.

Table 3: The Boating industry actions to date

We asked if the current situation is affecting the supply chains in the industry and that reply has edged up from a 65% to 67.7% response that respondents are experiencing supplier and material disruptions.

A balanced reaction about clients asking for deferred payments continues to be evenly split across the country.

This Wave brought fewer open comments. Still, these need to be read and considered before we report. Overall, a fast scan suggests that there were fewer really dire comments and this maybe because we are closer to a season opening. Some customers may be sending orders and making payments to help the cash flow crunch that many may have experienced two weeks ago.

Differing provincial requirements (and in some cases differing municipal regulations as well) may be a positive factor as some boats are now in the water in Quebec and Ontario while boats are generally launched in BC.

There is no doubt this has rocked our industry and the amazing, relentless efforts by all the boating associations across Canada, have gone a long way to supporting this industry and making our needs heard at the various government levels.

Next week, we will have crunched the open comments for more insights and will report in News Week May 12. For now, we want to again express our appreciation to all those people who took the time to answer this survey.