GROUPE BENETEAU REPORTS Q3 RESULTS AND NEW STRATEGIC PLAN

July 14, 2020

Groupe Beneteau has just released their 2019-20 nine-month revenues with the following results:

• Contraction of 17.3% after production was temporarily shut down due to Covid-19 (-17.9% at constant exchange rates)

Outlook for the year

• Revenues expected to be down 16% to 18%

• EBITDA margin of over 8%

• Income from ordinary operations above breakeven

Following first-half growth of 4.8%, the Group’s revenues for the third quarter, affected by the Covid-19 health crisis, came to €249.3 million, down 42.6% compared with the third quarter of the previous year. This contraction reflects the temporary shutdown of production for half of the quarter, before gradually starting up again due to the strict health constraints.

The Boat business is down 43.3%, while the Housing business is reporting a drop of 39.4%.

As a result, consolidated revenues for the first nine months of FY 2019-20 totaled €768.7 million, down 17.3% year-on-year and 17.9% at constant exchange rates. The Boat business is down 17.8%, while the Housing business, which was able to start its shipments up again slightly more quickly, recorded a 15.4% decrease compared with the same period in 2019.

Boat division: business affected across all segments and regions by the temporary production shutdown.

For the first nine months, Boat revenues came to €623.2 million, down 17.8% year-on-year and 18.4% at constant exchange rates.

As all of the Group’s plants were temporarily shut down due to the health risks, the contraction in revenues concerns all the segments and regions, which all show a downturn in business at end-May 2020, with the exception of fleet sales, which are up 26.8%, thanks to an excellent first half of the year (+60%).

On a reported basis, North America (-22.4%) was slightly less affected than Europe (-26.6%), despite a significant drop of -46.6% for the American brands. The contraction for other regions around the world came to -19.5%.

For the first nine months of the year, the downturn for motorboat segments (-21.7%) shows contrasting trends: the decline was limited for 30 to 60-foot outboard and inboard motorboats, but significantly more marked for the inboard (under 30 feet and over 60 feet) and jet segments.

Sailing revenues are down 13.5%, offset in particular by the fleet sales performance mentioned previously.

At end-May 2020, the Sailing and Motorboat segments each represent 50% of revenues for the Boat division.

Housing division: strong first-half trends stopped by the temporary production shutdown in the third quarter.

For the first nine months of the year, the Housing division recorded €145.3 million of revenues, down 15.4% compared with the first nine months of the previous year.

The positive first-half trends (+5.4%) were brought to a sudden stop by the suspension of production in the third quarter, which saw a 39.4% drop in revenues for the Housing division (€48.3 million) compared with the third quarter of the previous year.

Outlook for FY 2019-20

The gradual resumption of operations, ramped up from early May, will not be sufficient to make up for the lack of production during the six weeks of the shutdown. Combined with the order cancellations and deferrals recorded by the Boat business, particularly from charter firms, 2019-20 full-year revenues are expected to contract by 16% to 18% on a reported basis compared with the previous year.

The Housing division expects its full-year revenues to come in 13% to 14% lower than 2018-19.

In this context, the Group estimates that its full-year revenues will contract by 16% to 18% on a reported basis, with an EBITDA margin of over 8% and income from ordinary operations above breakeven.

The next key dates will be:

• July 9, 2020 at 6pm: presentation of the core features of the Group’s strategic plan “Let’s Go”

Beyond!” for 2020-2025

• September 8, 2020: new boat models announced for the 2020-2021 season

• October 27, 2020: 2019-20 full-year earnings released

Groupe Beneteau is announcing its strategic plan for 2020-2025: “Let’s Go Beyond!”. Strategic plan to emerge from the crisis in a stronger position.

Groupe Beneteau has further strengthened the strategic plan that it initially drew up during the first quarter of 2020 in order to move more quickly and go further with its adaptation to the period that is taking shape. A more developed financial breakdown of this plan will be presented in autumn 2020, when the Group releases its full-year earnings.

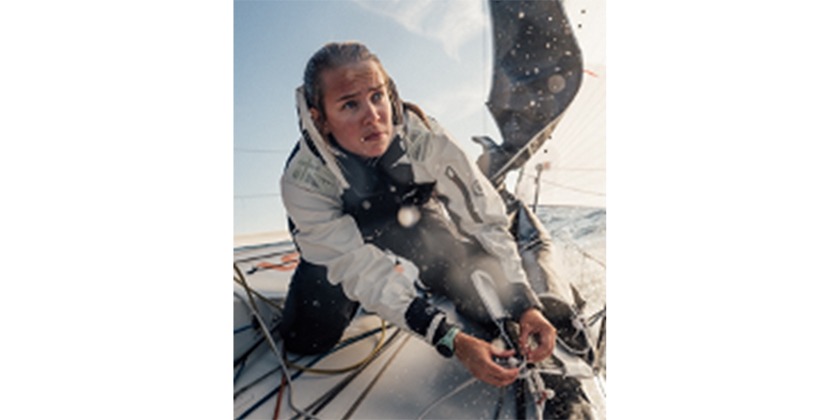

It is inspired by the ambition to facilitate access to the world of boating for everyone by creating simple and innovative solutions for life, with respect for nature and marine balances.

The Board of Directors has approved the plan proposed by the Executive Leadership Team, based on the following key pillars:

• A strategy built around eight global brands – compared with 12 previously – covering the same number of markets segments with reduced investment thanks to their complementary features and specific positionings;

• A better level of efficiency for the plants and an acceleration of development times, by specializing industrial assets and adapting product development resources in line with the Product Plan;

• A more streamlined managerial organization structured around global core functions.

This evolution is fully aligned with the Group’s commitment to being a pioneer for sustainable recreational boating.

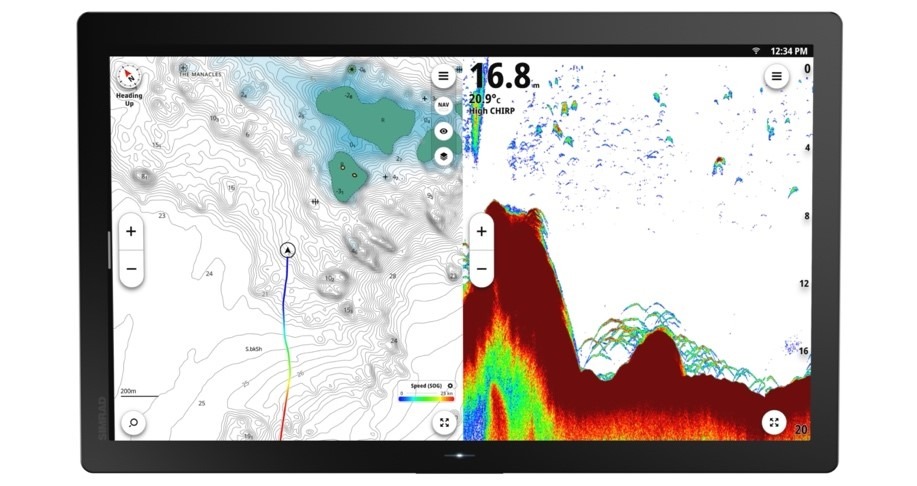

1. Moving forward, the plan also includes measures to expand its portfolio of downstream activities to include services, in synergy with its distribution networks. The Group’s future investments will be focused to a great extent on the digitalization of its activities (Band of Boats transaction platform, CRM, configuration feature, connected boats, etc.) and its processes (ERP, etc.).

The Housing division, the leading supplier of leisure homes for European campsites, will capitalize on the strong levels of interest in the outdoor accommodation sector and the premiumization of campsites. Thanks to its capacity for innovation and its effective management of production costs, it is targeting market share growth both in France and for export (Italy, Benelux), as well as a double-digit operating margin by the end of the plan.

The first phase of the plan will move forward in a market environment disrupted by the crisis resulting from Covid-19.

The post-Covid 19 crisis is bringing in a new economic cycle. During an initial period, from 2020 to 2021, the sharp contraction in activity worldwide, which is being observed, will affect the recreational boat market. This is expected to be followed by a significant upturn, whose scale will depend on how quickly the health crisis is resolved.

With over €600 million of shareholders’ equity at February 28, 2020 and €300 million of undrawn confirmed credit lines, which will be further strengthened with a €120 million State-backed loan, and zero net debt, as well as its experience managing previous crises, the Group is therefore preparing to take on board changes in volumes, initially falling then rising, potentially on a similar scale to that seen with the 2008-2009 crisis.

In view of this, it plans to significantly scale back its production capacity over the coming months, while reducing all of its fixed costs. Discussions are underway with the employee representative partners in France and other countries.

To be able to share wealth with its employees and shareholders, the Group needs to create it first.

This is the purpose of the Let’s Go Beyond! plan, which intends to achieve, when the markets have returned to their 2009 levels, operational profitability of over 10% of revenues.